Is chainlink safe?

Chainlink was created in 2017, and is a relatively new cryptocurrency. That means that there’s only a few places who accept chainlink as a legal payment method as of now.

In Denmark especially, the development is slow and almost no stores accept crypto here. If they do, it’s usually the most popular cryptocurrencies such as bitcoin and ethereum who are accepted, whereas a cryptocurrency such as chainlink is still too new to be accepted.

There’s a good amount of stores and organisations abroad who are beginning to accept cryptocurrency, but in Denmark the development is a lot slower. A country like Germany has ATMs , where you can buy and sell certain cryptocurrencies - again, typically bitcoin or ethereum.

Meaning that there’s uncertainty connected to chainlink, and whether or not you can use it as a legal payment method in the future.

If on the other hand you’re interested in trading chainlink with the purpose of using it as an investment , you need to be aware that all cryptocurrency trading involves risks and uncertainty .

Lastly, you need to familiarise yourself with chanlink’s underlying technology - meaning the blockchain and how that technology can be said to be safe or unsafe.

To figure out whether or not chainlink is safe, you should consider 3 things:

- Which countries accept cryptocurrency as a payment method?

- Why are investments in chainlink connected to risks and uncertainty?

- How safe is chainlink technologically?

Which countries allow chainlink as a payment method?

It can be uncertain to sit on large amounts of chainlink or any other type of cryptocurrency, if you plan on using the cryptocurrency as a regular payment method . It could work in countries such as El Salvador, where bitcoin has been regulated as a legal payment method since 2019. And that brings hope that chainlink sometime in the future could be accepted as a legal payment method. On the other hand, there are countries where the use of crypto is prohibited and illegal.

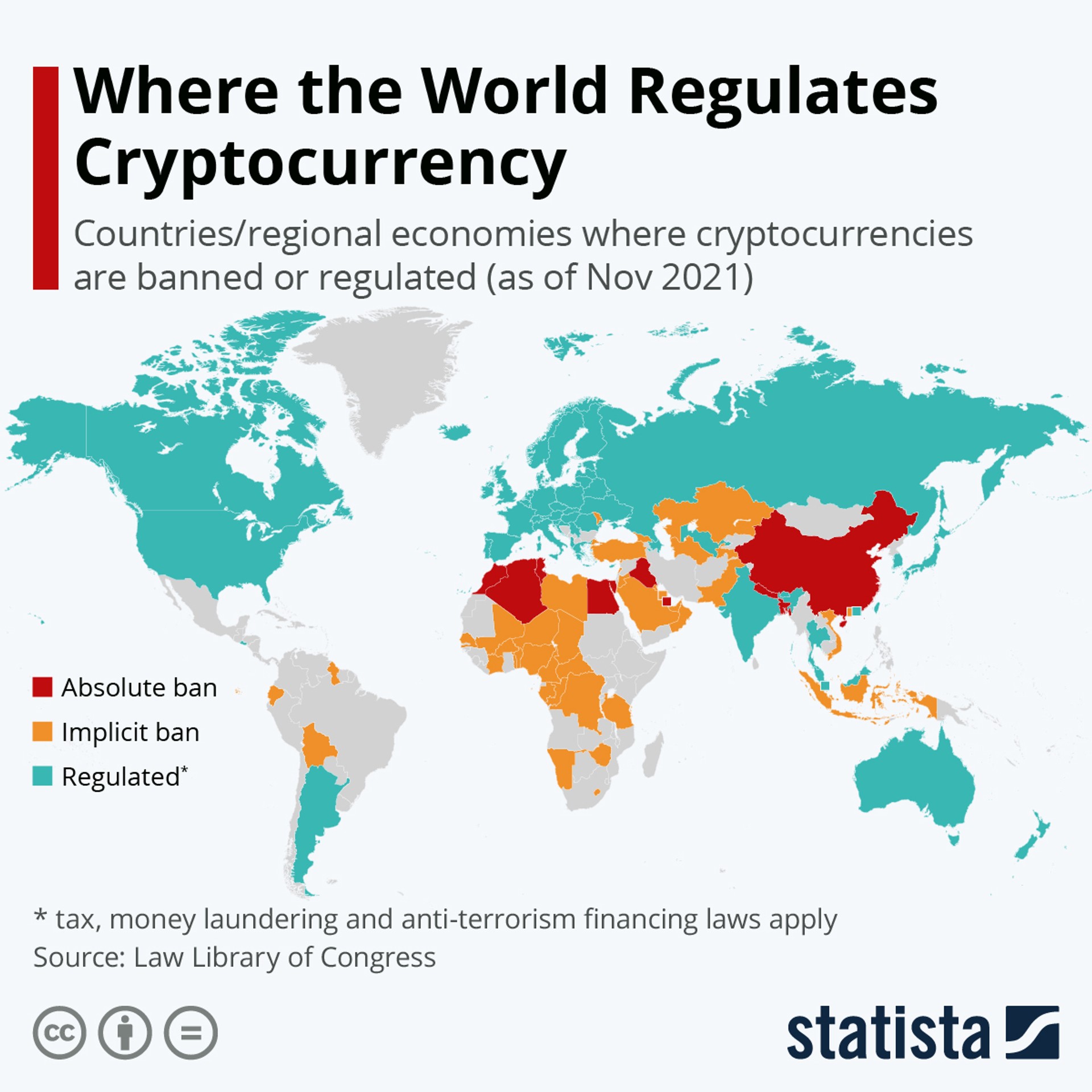

On the map from Statista you can see which countries who:

- Regulates crypto (blue)

- Implicitly bans crypto (yellow)

- Directly bans crypto (red)

Why are investments in chainlink connected to risks and uncertainty?

When you trade cryptocurrency and chainlink there’s a risk that you could lose parts or the entirety of your investment. This is because crypto and chainlink are unregulated assets. Meaning that there are no central authorities to protect you as a consumer.

If you have money in a bank, and the bank goes bankrupt, your money is protected by a central authority: In Denmark, that authority is Garantiformuen , who covers deposits equivalent to up to 100,000 euros.

But if you lose your chainlink tokens as a consequence of a crypto platform going bankrupt, you’re not protected.

That’s one of the reasons why chainlink is an uncertain investment. You don’t have access to the same safety net here, because cryptocurrencies still are unregulated assets as of 2022.

Besides that, chainlink and other cryptocurrencies are very volatile assets . That means that the prices of them can rise and fall very quickly in value from one day to the next. The more volatile an investment is, the more uncertain it is. The same goes for any other assets such as stocks or real estate investments.

If you’re considering buying a house for example, you would be more cautious of purchasing it if you knew that the price of the house potentially could lose up to 100% of its value from one day to the next. But at the same time, there’s a risk that the house could be worth 10 times as much the next day.

That’s also kind of how chainlink works. You should consider whether or not chainlink is in line with your willingness to take risks.

Cryptocurrencies can rise and fall

When you trade cryptocurrencies, you need to be aware that it carries a large risk. The value of your cryptocurrency can both rise and fall, and you can risk losing the entire amount you’ve invested in cryptocurrencies.

Cryptocurrency trading is done through Lunar Block. Lunar Block is not regulated by the Danish Financial Supervisory Authority (Finanstilsynet). That means you won’t have the same protection as when trading e.g. stocks or other regulated assets.

We do not counsel

We do not advise on currencies and do not make recommendations for either buying or selling. We can provide factual information about the different currencies, but past price developments are not an indication of future developments.

No information from Lunar Block should therefore be considered as recommendations and all decisions are up to you alone.

How safe is chainlink technologically?

Chainlink uses proof-of-stake to validate transactions on their blockchain. This means that there’s a large incentive to validate transactions correctly, because the validator could otherwise risk losing large amounts of their chainlink holdings.

Tip: Read more about blockchain here .

In proof-of-stake, people who validate transactions receive a fee for their work. That’s why a lot of people are interested in being selected as a validator.

The selection is based on a type of lottery draw, where a single lot is equal to the amount of chainlink tokens you’ve staked - that’s why it’s called proof-of-stake.

Let’s say there are 100 tokens in total, and you’re staking 5 in the draw. You would then have a 5/100 chance of being selected - or a 5% chance.

When you win and get selected, you now get to validate the next block of transactions, which triggers a financial reward in the form of chainlink tokens.

And if you try to trick the network - for example by typing in false information - you will get punished, and the 5 tokens you’ve staked will be confiscated.

Chainlink’s technological security is thus tied up to the principles of proof-of-stake, which discourages validators from fraud, because they risk getting their stake confiscated.

When the transactions have been validated, the information is spread out to the rest of the blockchain network. And this is where any fraudulent activity will get caught. The network will report back if the transactions aren’t correlating with their own information, and the person responsible for the fraudulent or false transactions will be punished.

Tip: Read more about chainlink’s blockchain and the proof-of-stake technology here .

Cryptocurrencies can rise and fall

When you trade cryptocurrencies, you need to be aware that it carries a large risk. The value of your cryptocurrency can both rise and fall, and you can risk losing the entire amount you’ve invested in cryptocurrencies.

Cryptocurrency trading is done through Lunar Block. Lunar Block is not regulated by the Danish Financial Supervisory Authority (Finanstilsynet). That means you won’t have the same protection as when trading e.g. stocks or other regulated assets.

We do not counsel

We do not advise on currencies and do not make recommendations for either buying or selling. We can provide factual information about the different currencies, but past price developments are not an indication of future developments.

No information from Lunar Block should therefore be considered as recommendations and all decisions are up to you alone.

Last updated April 18, 2023. We’ve collected general information. Please note, that there may be specific circumstances that you and your business need to be aware of.

You might also like...

Where can I pay with solana?

Cryptocurrency is becoming so widespread and acknowledged abroad that you can use the currency just like regular payment methods on some...

How do you buy solana as regular stocks?

Because solana (SOL) is a currency, and not a business, you can’t actually invest directly in solana like it’s a stock.

Are cryptocurrencies a good investment?

Cryptocurrencies can be a great addition to your portfolio - if you’re willing to run the risk. Cryptocurrencies are “high risk - high...

What is bitcoin?

Bitcoin is a digital currency, or cryptocurrency, as it’s also called. Bitcoin is the first and largest cryptocurrency measured on market...